COVID Tests

Dating back to 1st July, 2021 expenditure on COVID tests necessary to attend work will be tax deductible. If the employer provides the test these will be deductible to the employer and exempt from FBT under the otherwise deductible rule.

We expect that just like other items that are used both for private and work purposes you

will need to apportion the expense. For example if you buy a box of 5 Rapid Antigen tests

and your child uses one for school then only 80% of the cost of the box will be tax

deductible. You will probably need to keep a diary to work this out.

If you require a COVID test in order to travel but the travel has a work and private

component. The explanatory memorandum suggests the cost has to be apportioned in that

case.

Not only do we need to know more detail now, but how do we recreate records back to 1st

July, 2021? The best we can recommend is that you keep a diary for at least a month of how

you are using all the COVID tests you buy now, in the hope the ATO will allow that to be the

basis of apportionment for the full year.

You may find that your employer will want you to provide them with a declaration as to how you have used the COVID tests they have given you.

There is also a problem with substantiating the expense. Sure, most of us now know to keep receipts going forward but have we kept receipts back to the 1st July, 2021? Will the ATO allow an estimate because we were not aware that they would become tax deductible back then?

Individuals

Income Tax:

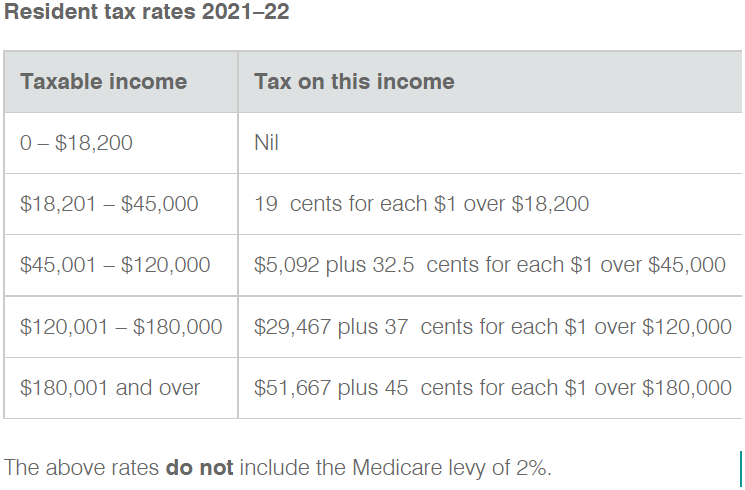

The low and middle income tax offset (LMITO) currently provides a reduction in tax of

up to $1,080 for individuals with a taxable income of up to $126,000. This will be increased

by $420 to $1,500 for the 2021-22 year, payable when you lodge your tax return. The

LMITO will disappear completely from the 2022-2023 financial year. The proposed 2021-

2022 LMITO will apply as follows:

| Taxable income | Offset |

|---|---|

| $37,000 or less | $675 |

| Between $37,001 and $48,000 | $675 plus 7.5 cents for every dollar above $37,000, up to a maximum of $1,500 |

| Between $48,001 and $90,000 | $1,500 |

| Between $90,001 and $126,000 | $1,500 minus 3 cents for every dollar of the amount above $90,000 |

In the 2022-2023 financial year, according to current budget statements there will be no

LMITO so some Taxpayers will effectively be in a higher tax bracket next year than this year. There is no incentive to accelerate tax deductions, if you think your income will be similar, they may be worth more to you next year. In fact next year and the year after may be the important years to save up your tax deductions for. They maybe your highest tax years ever because there is no LMITO and the reduced tax rates due to start in the 2024-2025 financial year meant that from 1st July 2024 taxpayers earning over $45,000 but under $200,000 will pay a maximum tax rate of 30% plus Medicare.

Cost of Living Payment

A one-off $250 ‘cost of living payment’ will be provided to Australian resident recipients

of the following payments and concession card holders:

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment

- Carer Allowance (if not in receipt of a primary income support payment)

- Jobseeker Payment

- Youth Allowance

- Austudy and Abstudy Living Allowance

- Double Orphan Pension

- Special Benefit

- Farm Household Allowance

- Pensioner Concession Card (PCC) holders

- Commonwealth Seniors Health Card holders

- Eligible Veterans’ Affairs payment recipients and Veteran Gold card holders.

The payments are exempt from taxation and will not count as income support for the

purposes of any income support payment. An individual can only receive one payment.

Home Buyers

The government has launched a new guarantee scheme in the budget, which is specifically geared towards regional buyers. Under the Regional Home Guarantee, borrowers in regional areas (including those who aren’t first home buyers) will be able to buy or build a new home with a deposit as small as 5 per cent, while the government guarantees 15 per cent of the property purchase price. The scheme applies to Australian residents who have not owned a home in five years. It starts from 1st October 2022 and ends 30th June 2025.

It is important to note that the government only guarantees 15% of your loan so you don’t

have to pay mortgage insurance, they are not actually giving you the 15%. Accordingly, it

does not improve your ability to repay, in fact you have to repay 95% of the purchase price. So for example if you have a $50,000 deposit you could buy a million dollar house. But

only if you can afford to meet repayments on a $950,000 loan. Here are a couple of tools to

help you work out your ability to repay.

See what you think – Loan calculator

https://www.noelwhittaker.com.au/resources/calculators/loan-calculators/

Then see what the bank is likely to think:

https://www.westpac.com.au/personal-banking/home-loans/calculator/mortgage-calculator/maximum-borrowing-calculator

There is also an existing scheme to help first home buyers buy a home with as little as 5%

deposit, that has no end date. The same ability to repay issues as discussed above apply.

The existing single parents scheme that allows families to buy a house will as little as 2%

Deposit will finish at 30th June, 2025. Single parents can have previously owned a home.

Business

120% Deductions:

There is a training and digitalisation incentive that will give businesses with a turnover

of less than $50mil a $120 tax deduction for every $100 spent. While this incentive covers expenditure after budget night the extra 20% tax deduction does not kick in until you 2023 tax return. So no need to rush out and spend money now in the hope of reducing your 2022 tax bill. The money spent will still qualify for a deduction in the year you spend it you just won’t see the extra 20% bonus until well over a year from now.

Very light on defining what will qualify as training and digitalisation. We will bring you

up to speed on that in another blog when it is available. Here is what we know so far:

Digital Adoption – Portable payment devices, cyber security systems or subscriptions to

cloud based services. Must be installed ready for use by 30th June 2023. There is a cap of

$100,000 per year, so if you think you might exceed this cap there is an incentive to rush out

before 30th June 2022.

The 120% tax deduction also applies to plant and equipment that relates to digital

adoption. This plant and equipment will also qualify for an immediate write off.

Training – The training must be provided by an external provider, in Australia or online

from Australian providers, to employees. Available up to 30th June 2024. This does not

appear to have the $100,000 cap.

Immediate Write Off for Plant and Equipment:

There was no extension in the budget for the immediate write off of plant and equipment so

this is all set to come to an end on 30th June 2023 and the P&E must be installed ready for use by that date, not just ordered. As it currently stands from 1st July 2023 any equipment costing more than $1,000 must be depreciated.

Keeping your ABN Active:

Starting with the 2022 tax return, if you don’t lodge your tax return on time the ATO will

cancel your ABN. Further, starting from 1st July 2023 the ATO will require you to update

your ABN information even if the details have not changed.

Subsidising Apprenticeship Wages:

Not just the building trades, this does cover Chefs and Hairdressers. The subsidy is for 12 months and only applies to new apprentices, though once you qualify for this you may receive further funding for years 2 and 3 of their apprenticeship. The trap is it only applies to new apprentices you put on between now and 30th June 2022. Yep, that is right less than 3 months. So very little time for planning, organising cash flow or interviewing and in many cases problems associated with starting apprentices part way through the education year. So while it is only likely to apply to employers who had already decided to take on an apprentice anyway, it would also be limited to those with flexibility in the education process.

This is what they are offering:

- 50 per cent of the eligible Australian Apprentice’s wages in the first year, capped at a maximum payment value of $7,000 per quarter per Australian Apprentice

- 10 per cent of the eligible Australian Apprentice’s wages in the second year, capped at a maximum payment value of $1,500 per quarter per Australian Apprentice, and

- 5 per cent of the eligible Australian Apprentice’s wages in the third year, capped at a maximum payment value of $750 per quarter per Australian Apprentice.

This one tops the heap as election propaganda.

More Frequent Reporting to the ATO:

There are may increased reporting requirements in the pipeline. For this reason and the

health of your business we recommend that your quarterly BAS now become a key point in

time to review your figures and tax strategies with your Accountant.

Tax Free COVID Grants:

More COVID grants were added to the list on non assessable non exempt income.

- New South Wales Accommodation Support Grant

- New South Wales Commercial Landlord Hardship Grant

- New South Wales Performing Arts Relaunch Package

- New South Wales Festival Relaunch Package

- New South Wales 2022 Small Business Support Program

- Queensland 2021 COVID 19 Business Support Grant

- South Australia COVID 19 Tourism and Hospitality Support Grant

- South Australia COVID 19 Business Hardship Grant

Julia's Blog

Julia's Blog