Pay careful attention this year because it is very likely that your tax deductions are never going to be so valuable again.

For every dollar you spend on tax deductions, if your income is between $45,000 and $120,000 the ATO will refund you 34.5 cents where as next year it will only be 32 cents and if you are earning between $120,000 and $135,000 the difference is 39 cents this year compared with 32 cents next year. Ok well maybe not worth buying a reem of paper for but for businesses buying equipment under $30,000 and all individuals with the ability to make extra superannuation contributions the difference is significant. Here are the rate comparisons to help you work out what benefits are available to you.

| Tax Rates for 2023-2024 Financial Year | Tax Rates for 2024-2025 and following years | ||

|---|---|---|---|

| 0 - $18,200 | Nil | 0 - $18,200 | Nil |

| $18,201 - $45,000 | 19% | $18,201 - $45,000 | 16% |

| $45,001 - $120,000 | 32.5% | $45,001 - $135,000 | 30% |

| $120,001 - $180,000 | 37% | $135,001 - $190,000 | 37% |

| $180,001 + | 45% | $190,001 + | 45% |

Note the above rates do not include the Medicare levy which is usually 2%

While this blog goes into great detail on the opportunities, if it was to cover all of the possible traps it would become very boring so please consult your Accountant. Using this blog to prepare for and make the most of your consultation.

Pay What You Can Off Your HECS Before 1st June 2024

This is not a means of shifting taxable income from 2024 into 2025, this is all about avoiding the inflation uplift if you have the cash to spare and no loans with an interest rate of more than 4.7% where the money could be put to better use. It is listed first here because it requires urgent action before 1st June, 2024.

Each year at 1st June your HECS and similar debts are indexed for inflation. Last year the uplift was 7.1%, this year it is expected to be between 4.2% and 4.7%. This is a whole year’s uplift in one day. The HECS your employer deducts from your pay does not reduce your HECS debt until your tax return is lodged, so it will not reduce your debt as at 1st June 2024. If this is your last year of paying HECS and you can find the funds to pay off the debt at the end May then you will save yourself up to 4.7%. When you do your tax return in July all the employer deductions will be refunded. For more information about making early payments https://www.ato.gov.au/individuals-and-families/study-and-training-support-loans/voluntary-repayments

Note on the 5th May 2024 the government announced that the uplift factor would now be the lower of the Consumer Price Index (CPI) or the Wage Price Index (WPI). Even better news is this is going to be backdated to 1st June 2023 which means the 2023 uplift will be reduced from 7.1% down to 3.2%. For the 1st June 2024 uplift, the WPI is likely to be around 4.2% and CPI around 4.7%.

Consider the following tax planning strategies:

Individuals

Before the 30th June get your log books and diaries in order. For many claims you need a month’s diary to apportion private and business use. You need to show the ratio of work to private use for a laptop, internet etc by recording each hour’s use for a month. It is easier with your phone, just screen shot a month of recent calls before 30th June 2024, print them and mark each call either work or private.

For cars you have a choice of the log book method or claiming up to 5,000 kilometres at 85 cents a kilometre. The kilometre rate is quite effective if you have had the car for quite a few years and are not travelling a lot for work. Even if you do travel more than 5,000kms you can just reduce your claim to 5,000kms. You will need a detailed reasonable estimate. This could be diary of a typical month plus a list of one off exceptional trips. Alternatively, the log book method allows you to claim a portion of the interest on the car loan, the insurance, depreciation or lease payments, fuel, repairs etc. The portion is determined by keeping a log book for 3 months every 5 year, you will at least have to have it started it by 30th June. You also need receipts for the expenses though as long as the vehicle is a car, not a one tonner, bus or truck you can estimate the fuel costs. Take the speedo reading before you fill up and the speedo reading the next time you fill up and keep that receipt. Work out how much per km the fuel is costing you and multiply it by the kilometres travelled for the year. Regardless of the method used (it is compulsory for log book method) and even if it is a company vehicle we recommend you take the speedo reading every 30th June. No harm done if you don’t need it. Note if you or a family member do not own the car then you can’t claim for its use. An example of this is where you salary sacrifice through a novated lease arrangement. As your employer makes the lease payments they “own/hold” the car.

Claiming your home office costs at 67 cents an hour has become difficult with the ATO expecting you to have a record of every hour you worked from home for the whole year. A one month diary will no longer do. Further, if you use the 67 cents an hour method you cannot claim for your phone, stationery, printer cartridges, internet or electricity. Accordingly, it may be more profitable to claim on the basis of actual costs. For example receipts for stationery and a one month diary for electricity, internet and your phone. We have a spreadsheet that will help you keep the home office records you need with detailed instructions https://www.bantacs.com.au/shop-2/home-office-2023-and-ongoing/ If you are a client of BAN TACS just contact your Accountant and they will email you the spreadsheet.

Delay income if at all possible, for example ask your employer not to pay your bonus until July.

Rental Properties

You can only pay rental expenses up to a maximum of 12 months in advance. In the case of interest payments check if the bank will let you do this and that they do treat it as an interest payment not just let it reduce the loan balance.

If you pay rates, insurance or body corporate fees in advance think carefully about the no more than 12 months in advance rule. If your body corporate fees are already paid up to 31st December 2024 you can’t pay another 12 months’ worth, you need to just pay 6 months extra.

Land tax is treated differently. When you receive land tax assessments in arrears, the amount of land tax is not deductible in the income year in which you pay the arrears. The land tax amounts are deductible in the respective income years to which the liability for the land tax relates.

If your property is a commercial property the rent is probably tax deductible to your tenant. If they are cashed up and well informed they are going to try an pay 12 months rent in advance before the 30th June. If that is within their lease term you will have difficulty trying to argue it is unearned income so have to include it as income in the high tax rate 2024 year.

This is the year to get on with any repairs you have been considering. It is the year that the expense is incurred that counts. Incurred means that you have a clear liability to pay the expense even if you have not actually paid it. Consider at least accepting a quote before 30th June, if you don’t have enough time to complete the repairs. But be careful it is a repair, not an improvement or replacement in its entirety.

An improvement takes the condition of the property beyond when you first purchased it. You might consider it a repair to restore the property to its, as new condition but the fact it needed doing when you purchased it means it is an improvement. An improvement that is not plant and equipment is only going to be depreciated at 2.5% a year so not very useful as a year end strategy.

Replacement in its entirety, to qualify as a repair there must be something of the original item left. The entirety could be the building itself so replacing the whole roof would not be a replacement in its entirety because it needs the walls to hold the roof up, so some of the original is left. On the other hand completely replacing a kitchen is considered a replacement in its entirety. The better option is to leave the basic cupboard there and replace the doors. Don’t replace the whole fence in one go, repair each section over a period of years to get a full deduction rather than have to depreciate it over 40 years.

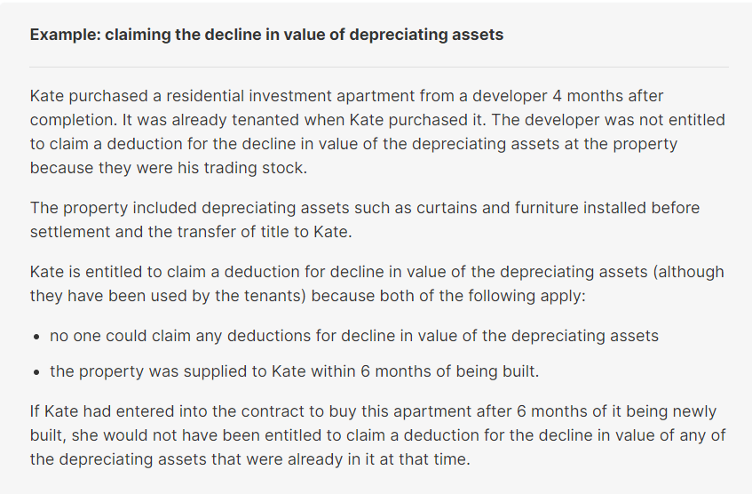

New plant and equipment is a replacement in its entirety, such as a stove, carpet, air conditioner etc. At least plant and equipment have a higher depreciation rate, generally around 20% but that is prorated for the portion of the year that it has been installed ready for use. If the asset cost you less than $1,000 you can claim 18.75% in the first year. If it cost you less than $300 you can write it off immediately. Note that is $1,000 or $300 per owner so if the property is jointly owned by a couple a $599 dishwasher could be immediately written off. Like items must be added together when applying the $300 test so it may be better to buy one set of curtains this year and wait until July before you buy the next set. There are a couple of traps to watch out for with plant and equipment. To depreciate it you must be the first owner and it must be first used to produce income. If you have used it first yourself, even if you have just lived in the house and not even used it, you cannot depreciate it. Further, you need to be the first purchaser of the plant and equipment from a seller who holds it as trading stock. So for example if you contract a builder to install a kitchen and they buy the stove from the retailer, not you, then it is secondhand when you buy it off them and you cannot depreciate the item. There is an exception to this if the builder is doing a substantial renovation that effects every room in the property. The take away from this is to make sure you buy all plant and equipment items yourself and just employ the contractors to install them. There is an interesting carve out when you purchase a property from a builder that has been rented out for less than 6 months. This is best explained by the ATO example:

A repair can become an improvement, if the repair goes beyond just restoring things to their original state, for example replacing a metal roof with tiles is not a repair. But a change is not always an improvement. The ATO says the cost of removing carpets and polishing the existing floorboards is a deductible repair, yet underpinning due to subsidence is considered to be an improvement. Pulling up old floor tiles and replacing them with similar tiles would be a repair as long as the tiles were not in disrepair when you purchased the property.

Take care to perform repairs only when the premises are tenanted or in a period where the property will be tenanted before and after with no private use in the middle. If a property is used only as a rental property during the whole year, then a repair would be fully deductible even though some of the damage may have been done in previous years when the property was used for private purposes.

Tree removal is claimable if the trees have become diseased or infested during the time of ownership. Removal is also claimable if the tree is causing damage such as roots interfering with pipes, but not if the damage was present when you purchased the property. If a tree is removed because it may cause damage in the future or you are fed up with the leaf litter that has always happened since you bought the property, then you are making an improvement which is not tax deductible, it will only be useful in your CGT calculation.

If your tenants have moved out and you do not intend re letting the property. If you don’t incur the repairs now you will not be entitled to a tax deduction next year because the property has not earned any rental income in that year. Reference IT 180.

If your rental property was built or renovated after 16th September, 1987 and you do not already know the building costs or have a building depreciation schedule then make sure you get one before 30th June, 2024 so it can be fully claimed as a cost of managing your tax affairs in 2024 at the higher tax rates.

Businesses

Immediate asset write off – There is so much uncertainty here that it is very difficult for business to plan. The threshold stated in the 2023 and the 2024 budgets was set at $20,000 but the opposition in the Senate tried to change the amount to $30,000 for this financial year. The government appears to be standing firm at $20,000 but this may mean the bill could lapse completely and we will be left with a $1,000 immediate write off threshold.

Assuming the legislation proceeds according to the budget announcements then equipment has to be installed read for use before 30th June 2025. It actually has to cost under $20,000 but that is per item. If the business is entitled to claim GST on the purchase then the $20,000 threshold is tested against the net of GST price. It is not recommended that you rely on the $30,000 threshold getting through. If your purchase is over the threshold, whatever that may end up being, you will only be able to write off 15% of the purchase price this year.

There are incentives for training and energy efficiency which allow you to claim 120% of your expenditure. In the case of the training boost only expenditure that is paid for by 30th June 2024 can qualify, it does not apply next year, so there is a double incentive to spend money in this area. The payment must be from the business to a registered training provider, reimbursements to employees will not qualify. The following websites can help you clarify if your trainer is registered https://www.teqsa.gov.au/ and https://training.gov.au/ If you are operating as a sole trader or a partnership, training the business owners does not qualify, it is only for employees, so even contractors don’t qualify.

The energy efficiency upgrades are still not law but intended to apply to the purchase of assets or upgrades that are first installed ready for use between 1st July 2023 and 30th June 2024. It is expected to cover electrifying heating and cooling systems, upgrading to more efficient fridges and induction cooktops, installing batteries and heat pumps. The maximum bonus tax deduction is $20,000 so there is no point in spending more than $100,000 but if you do it won’t stop you being able to claim the $20,000 maximum.

Delay income and pre pay expenses to shift as much as you can into the 2024-2025 lower tax brackets. Incurring expenses will work too even if you haven’t pre paid them. Incurring an expense means being committed to paying it, such as already receiving the goods or approving the quote for works. When it comes to plant and equipment pre paying is not going to help as it will need to be installed ready for use. Pre payments can only be 12 months in advance. Consider paying up to 12 months rent in advance if you have the cashflow. This is probably more constructive than buying stuff you might not need. If you pay interest in advance make sure your bank actually charges you the interest otherwise it will be just treated as paying principle off your loan.

With most businesses now using software that regularly updates from bank feeds, your Accountant should easily be able to prepare interim accounts and decide how much you have available to spend without pushing your tax bracket down too low or ruining your cashflow. They will also be able to guide you in the most effective strategies for your particular circumstances. Also consider the tips above, for individuals and superannuation contributions.

Superannuation

It is important to consider that the only superannuation strategy here that will take advantage of the change in tax rates after 1st July 2024 is the making of concessional tax deductible contributions before 30th June 2024. All the other superannuation incentives will be just as valuable next year as they are this year. Of course, taking advantage of them in both years is ideal but if funds are limited concentrate on tax deductible superannuation contributions and other tax deductions discussed above first.

Concessional tax deductible superannuation contributions can be made through your employer via salary sacrifice or you can make a payment direct to your superannuation fund stating that they are voluntary member contributions and completing a notice of intent to claim a tax deduction so that the amount you contribute can be claimed in your 2024 tax return. There is an annual cap of $27,500 and it includes your employer’s contributions. If your superannuation balance as at 30th June 2023 was under $500,000 you can contribute over and above the $27,500 if you have any unused caps from the last 5 years. The 2024 financial year is certainly the one to use this up on but be careful you don’t take your income down below $18,200.

Non concessional non tax deductible superannuation contributions are generally made as part of a strategy to get as much money in the low tax superannuation environment as possible. If you are under 75 years of age and have less than $1.9mil in superannuation it may be worth your while to discuss a non concessional contribution strategy with your financial planner. If you are over 60 a recontribution strategy can help reduce the taxable portion of your superannuation so that your adult children can receive more tax free. The cap for non concessional contributions can be as high as $330,000 if you draw forward from the next two year and have a superannuation balance of less than $1.68mil. Drawing forward means that you will not be entitled to make any non concessional contributions in the following two years so if you want to put say $470,000 into super it is best to put just $110,000 in before 30th June 2024 and put the remaining $360,000 into super in July 2024 utilising draw forward and the increase in the cap next year to $120,000.

Division 293 imposes an additional tax of 15% on superannuation contributions when your income is over $250,000. Here is a little trick that might interest you. It is $250,000 in adjusted taxable income which means adding back things like losses on your investments. Any extra superannuation contributions that you claim a tax deduction for will be added back onto your income so that won’t help you bring your adjusted taxable income down. The definition of superannuation contributions that will be added back are those that are treated concessionally, that is the key. Now odds are if you are on more than $250,000 a year you are already using up your $27,500 maximum concessional contributions cap through the employer superannuation guarantee. So, if you were to make a further superannuation contribution for yourself and claim a tax deduction for it the ATO would pick this up and make you pay a top up tax to bring the tax paid on the contribution up to the maximum tax rate. You can pay this top up tax direct or it can be paid by your superannuation fund and it is the amount you would have paid if you had not made the contribution anyway. As these contributions over the $27,500 cap are no longer concessionally taxed they no longer added back when calculating the $250,000. Further as these contributions will not be concessionally taxed the super fund will not deduct any 15% contributions tax.

For example, if you were earning $280,000 in taxable income you could put $30,000 into super and claim a tax deduction for it in your tax return bringing your taxable income down to $250,000 so no Div 293 on the $27,500 your employer contributed. The $30,000 is still tax deductible in your tax return but it is not added back because it does not receive concessional treatment in the super fund because the top up tax is triggered. The top up tax just means you end up paying the tax that you would have paid had you taken the amount as wages but you have saved $4,125 ($27,500 x 15%) in Div 293 tax. The only downside is you have more money locked away in super until you retire. Careful – Make sure that you have not used up all of your non concessional cap. Seek advice if you have been making contributions for superannuation that you have not been claiming a tax deduction for as you don’t want this strategy to push you above the non concessional cap.

Superannuation contribution incentives for low income earners. The government will contribute $500 into your superannuation account if you make a non tax deductible contribution of $1,000 and your income is under $43,445 (shades until you reach $48,445) but also you need to have at least 10% of it from employment or business as a sole trader or partnership. Income for the 10% test is the business income before deductions. Income for the $43,445 test is your assessable income without deductions (unless those deductions relate to business income) plus reportable fringe benefits and reportable superannuation contributions. You also need to be under 71 years of age, have less than $1.9mil in superannuation and not have maxed out your non concessional contributions cap.

If you spouse has an income of less than $37,000 you could put up to $3,000 into their superannuation account and receive an 18% tax offset in your tax return, maximum of $540. The benefits shade out to nothing once your spouse’s income reaches $40,000. The definition of income includes assessable income (income before tax deductions including deductions for superannuation contributions). This assessable income is further increased by adding reportable fringe benefits and reportable superannuation contributions. Further conditions are, your spouse has to be under 75 years of age, not maxed out their non concessional contributions cap and have less than $1.9mil in super at 30th June 2023. These contributions are not taxed going into the superannuation fund.

This table is a quick reference of all the superannuation caps.

| Contributions caps and thresholds | 2023–24 | 2024–25 |

|---|---|---|

| Concessional contributions (CC) cap | $27,500 | $30,000 |

| General non-concessional contributions (NCC) cap | $110,000 | $120,000 |

| General NCC cap under 3-year bring forward rule (see Table 2) | $330,000 | $360,000 |

| Carry forward of unused concessional contributions — total superannuation balance (TSB) just before the start of the financial year | < $500,000 | < $500,000 |

| CGT cap amount | $1,705,000 | $1,780,000 |

| Division 293 tax threshold | $250,000 | $250,000 |

| Government co-contribution: • Maximum amount • Lower income threshold • Higher income threshold | $500 $43,445 $58,445 | $500 $45,400 $60,400 |

| Low income superannuation tax offset where adjusted taxable income does not exceed $37,000 | Up to $500 | Up to $500 |

| Work test exemption for those aged 67–74 (only in their first year of retirement) — based on TSB of individual at the end of the previous financial year | $300,000 | $300,000 |

| Bring forward period: 2023–24 to 2025–26 Total superannuation balance on 30 June 2023 | NCC cap for 2023–24 (first year) | Maximum bring forward period |

|---|---|---|

| Less than $1.68 million | $330,000 | 3 years |

| $1.68 million to less than $1.79 million | $220,000 | 2 years |

| $1.79 million to less than $1.9 million | $110,000 | No bring forward period — general NCC cap applies |

| $1.9 million or more | Nil | Not applicable |

| Bring forward period: 2024–25 to 2026–27 Total superannuation balance on 30 June 2024 | NCC cap for 2024–25 (first year) | Maximum bring forward period |

|---|---|---|

| Less than $1.66 million | $360,000 | 3 years |

| $1.66 million to less than $1.78 million | $240,000 | 2 years |

| $1.78 million to less than $1.9 million | $120,000 | No bring forward period — general NCC cap applies |

| $1.9 million or more | Nil | Not applicable |

Have you lodged your 2023 tax return?

If you do not lodge your 2023 tax return by 30th June 2024 you may have to pay back your Centrelink entitlements and that is final, you will not be able to reclaim them when you do eventually lodge.

If you are claiming superannuation contributions you have made for yourself, in your 2023 tax return, you need to have your notice of intention to claim lodged with your superannuation fund before 30th June 2024.

Julia's Blog

Julia's Blog