How would you interpret this piece of legislation?

900-50(1)

You can deduct a *travel allowance expense for travel within Australia without getting written evidence or keeping travel records if the Commissioner considers reasonable the total of the losses or outgoings you claim for travel covered by the allowance.

Each year the ATO issue a ruling stating the amount they consider reasonable. But if you are unfortunate enough to be audited on this you are unlikely to find the ATO auditors at all reasonable.

This leads me to the interesting case of Daniel Shaw an employee long distance truck driver. An ATO auditor decided they were not satisfied with the records Mr Shaw had and allowed him no deduction at all for any food or drink while he was travelling. There was no question that Mr Shaw was away from home for 310 days as this information was recorded in his log book and his employer paid him an allowance for each of those days. The ATO auditor simply decided that as Mr Shaw did not have receipts for all his meal expenses he was not allowed any tax deduction. That is right, basically the ATO argued that he did not need to eat despite the fact that he was away from home a week at a time and the law said he did not need written evidence! On objection the ATO conceded that he would have had to eat so they allowed him $19 a day despite the reasonable allowance published by the ATO being $105.75 a day. Mr Shaw stated that he actually spent more than $105.75 a day but to avoid the burden of substantiation he elected to claim the reasonable amount. He produced a year’s worth of bank statements to show transactions supporting the expenditure and a log book showing when breaks were taken.

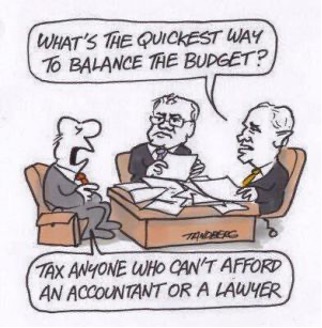

Fortunately, Mr Shaw had the means to object and take the matter to the Administrative Appeals Tribunal (AAT). Most taxpayers would have to give up and you can’t help thinking that is part of the ATO plan, why else would they be making such a ridiculous claim as basically deciding he did not eat.

The AAT was scathing of the ATO’s attitude. Some choice quotes from the sitting member:

- The ATO must act with some realism rather than trying to criticise Mr Shaw for not being able to itemise individual expenses from 5 years ago.

- The ATO only allowing $19 per day was absurdly inadequate.

- The ATO tried to claim that Mr Shaw had not provided a methodology to apportion or estimate the expenditure shown on his bank statements. The AAT member stated that the ATO could have determined a methodology from the evidence provided and pointed out the difficulty of what the ATO were asking considering Mr Shaw thought full substantiation was not required.

- “The Tribunal is not sure how the Commissioner thinks anyone would fund three meals a day for $19 in the Relevant Year, let alone for an individual of Mr Shaw’s stature. The Commissioner has a lot of data available (for example of average grocery spends) and there were available areas for investigation. The Commissioner could also have found credible submissions made to it accompanied by bank statements and other evidence, particularly where to do otherwise is to act so unrealistically.”

- The ATO even misquoted their own ruling to try to trick the AAT member but she wasn’t fooled.

- The AAT accepted Mr Shaw’s evidence on apportionment and stated that the ATO should also have accepted his word as it made practical sense. It is a balance of probabilities not proof beyond doubt.

- There was also the suggestion that if the ATO was not satisfied with the method used by the taxpayer to calculate their expenses they could simply ask for a short sample period of full substantiation, in the current year.

The AAT also accepted that it was quite believable that sometimes cash would be needed to buy food. Further, it was practical to buy groceries before actually leaving home to ensure he had enough food in the truck in case and that this expenditure is to be included.

There was some great guidance in the case as to what would be considered acceptable proof that a taxpayer has expended the reasonable daily allowance. “Maintain full substantiation of meal expenses for a short period in each year. This could comprise receipts of meals and receipts showing the specific groceries acquired for the trip, clear evidence of food acquired being in the truck (e.g. phone photos), bank statements and diaries to demonstrate periods away from home, meal breaks etc for a short period in a year.”

The current ATO ruling on reasonable allowances states that taxpayers cannot aggregate meals. It sets out an amount for each meal, breakfast, lunch and dinner and says if you spend less on one you cannot put the unspent amount towards the next meal. In fact for non truck drivers it even specifies the time period within which each meal must be eaten, which just seems to serve no other purpose than setting a trap. This case shows this restriction would not stand up in court. But don’t be complacent an ATO auditor will still point to that paragraph in the ruling and try it on.

Before you get too excited that common sense has prevailed consider that the ATO has appealed this case. With unlimited funding provided from our tax dollars justice is unlikely to be served. Further the last three budgets have increased the amount available to the ATO to audit the average employee taxpayer. The moral of this story is Audit Insurance. You will be amazed at how cheap this is if obtained through a reputable tax agent.

Tax Tip – This whole problem could have been avoided if the travel allowance paid to Mr Shaw did not appear on his PAYG summary. If the travel allowance is the reasonable amount or less and the employer considers the travel allowance fully expended they do not need to show the amount on the PAYG summary. This means the employee does not need to include it in their tax return but cannot claim any deductions against it. As the employer would pay the travel allowance without deducting tax this is the equivalent of fully offsetting the allowance with tax deductions. As long as the employer pays the reasonable amount the only way you could have a better outcome is to have the proof that you spent more for every travelling day for the whole year.

For our blog on Truck Driver tax deductions go to.

Julia's Blog

Julia's Blog