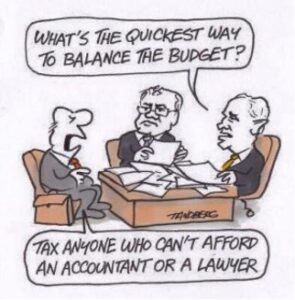

Doctors working in Medical Centres – GST and Income Tax

Download PDF Primarily this blog is intended for recently qualified doctors and dentists starting work in a practice. Once you move on to acquiring assets and an ownership interest in the Medical Centre this will open up further opportunities for tax strategies and responsibilities. We touch on this towards the end so you can …

Julia's Blog

Julia's Blog