Other than in the very rare circumstances where crypto is just purchased to buy a personal asset, any gain or loss you make on crypto is subject to tax. So don’t forget to bring your details with you when you do your tax return. The ATO are right onto data matching your transactions we are already seeing the sale come though on prefill reports. What we need from you is the cost of the currency sold, which as you will find out below is not as easy as you would expect.

Generally, an asset purchased with the sole intention of resale at a profit would be taxed on revenue account ie no 50% CGT discount but at least losses can be offset against other income. Shares are different because they also produce a dividend that provides a reason for owning them other than profiting from their resale. Nevertheless, the ATO currently are of the opinion that in most cases CGT applies to crypto. This means the opportunity of the 50% CGT discount if you hold the unit of currency for more than 12 months. It also means any losses are quarantined to be offset against future capital gains, not your other income.

Some of the profession think that CGT should not apply to crypto currency, that normal tax rates should apply because it was purchased with the sole reason for resale at a profit. There is also a major review of the taxation of digital currencies being undertaken. The ATO’s current view is available here https://www.ato.gov.au/general/gen/tax-treatment-of-crypto-currencies-in-australia—specifically-bitcoin/?page=2#Cryptocurrency_as_an_investment

One thing that is for certain your crypto currency trades are subject to tax and the ATO are going to fight you claiming any losses against your other income.

To work out the capital gain or loss on the sale of a crypto currency you need to know how much it cost you originally to buy and deduct that from the sale proceeds. In TD 33 the ATO allow you to match each bitcoin that you sell if it can be identified. If you can’t identify the actual coins being sold, then the matching must be done on a first in first out basis (FIFO). FIFO means you have to track each purchase to know when it is sold so you know which purchase you have worked your way down to, to match it with the current sale. Quite a messy business even if you can work out the XL formula to make this happen. The point is you do not want to pay your Accountant to do this for you. You need your platform to provide the right report and that is not always available. We recommend that you use Crypto Tax to get the report you need https://app.cryptotaxcalculator.io/signup

Mining:

If you have received your crypto currency through mining then the value of the currency you receive is business income and taxable in the year your receive it. This value is also your cost base when you sell the currency. So you will need to know the $AUD market value for each payment you receive, at the time you receive. This is both relevant to your current year taxable income for mining and your CGT records when you sell.

Expenses:

Strangely enough the ATO accepts that you can claim some expenses as a tax deduction in the year in which they are incurred rather than add them to the cost base. In the case of mining crypto consider claiming home office expenses at 80 cents an hour, more about home office expenses in this blog.

https://bantacs.com.au/Jblog/tax-deductions-when-working-from-home/#more-503

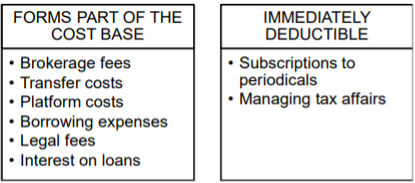

The treatment of expenses is another contentious issue that may change. We are relying on advice from Assistant Commissioner Adam O’Grady. When you are simply buying and selling (not mining) this is how the related expenses are treated.

Good news if you subscribe to magazines and other advice about crypto currencies but everything else is going to have to be recorded in your cost base calculation. Which does get extremely messy if you are doing a lot of buying and selling. We will also need this information to calculate your capital gain.

Say for example you borrow the money to buy a particular parcel of bitcoin, you will have to track the interest for that particular parcel because the interest on the loan needs to be matched to the asset it was used to purchase. Just to be clear, unlike shares where the interest is tax deductible in the year incurred because there is dividend income to offset it. Interest on Crypto currency needs to be included in the cost base of the currency the borrowed money is used to buy. Oh and by the way it can’t be used to increase a capital loss!

Transfer costs and brokerage fees are a bit simpler just treat them as if they are part of the purchase price.

Platform costs are treated the same as brokerage if they are based on transactions but if they are a flat monthly fee then they need to be treated the same as interest but across all of your holdings on that platform.

Legal fees would become part of the cost base for the transaction that you incurred the legal fees in relation to.

Just another good reason not to get involved in Crypto, if you ask me!

Julia's Blog

Julia's Blog