Check with an experienced property Accountant before you ever choose to register for GST. Get it wrong and you will have to pay the ATO 1/11th of the sale proceeds, even if the bank ends up taking the whole lot to repay your loan.

Twice in one week clients have come to us having been advised by two separate conveyancers that they must register for GST. So, we assume it is a wide spread misconception in the industry. This blog sets the record straight with references.

The first sale of a residential property is subject to GST if the owner of the property is registered or required to be registered for GST. Consider the situation where you build a rental property, a house and land package. When you sell that rental property, as many are currently doing due to recent price increases, it will be the first time that house and land have been sold together. So, yes, there is the supply of an item that is subject to GST.

There is a carve out for properties that have been held as a rental property for a continuous period of 5 years. These are no longer considered new properties. In the examples we had, both sellers had only held their rental properties for 4 years. The conveyancers were under the impression that it was an open and shut case, GST applied but there is much more to it than that. The question of whether they are required to be registered for GST needs to also be addressed.

Note, in the case of your own home GST cannot apply because it was not built as part of your enterprise it was built for private use.

The key point here is that GST only applies if the seller is registered for GST or required to be registered. If you are not required to be registered but your conveyancer talks you into registering the game is up you will have to pay the ATO 1/11th of the sale proceeds and there is no slipping under the radar, the purchaser will withhold the amount and send it to the ATO. The only glimmer of hope that you have is reducing the amount by including a margin scheme clause in the contract if applicable.

Required to be Registered for GST?

You are required to register for GST when your turnover exceeds $75,000. Input taxed supplies (residential rents) are not included in this amount. So, it is a question of whether the house sale is part of your turnover. This issue turns on your reasons for building it. The onus is on you to prove this of course. Turnover is the sale of goods that the business holds for resale. If you hold a property as an investment, that is predominantly to earn rent then the sale of that property is the sale of a capital asset so not part of your turnover. On the other hand if you built that property with the primary intention of selling it at a profit but maybe rented it out for a while until the market improved then the eventual sale of that property would be part of your turnover and that is where you would be required to register for GST because the sale proceeds would exceed the $75,000. It is all about your intentions, your thoughts, try to keep some independent evidence of your thoughts at the time of buying or building just in case!

What if you are Already Registered for GST?

This could be the case if the property was purchased in one person’s name and that person may also be a sole trader who is registered for GST for their business. In this case you would need to argue that you do not own the property as part of the enterprise that you are registered for GST for. Not much hope here if you are a builder.

In the situation where the property maybe owned jointly and one of the owners are registered the argument that it is not held as part of their enterprise is very easy. The GST Act recognises a partnership as a separate legal entity for GST purposes, so you are ok if there is no partnership registered for GST. If both owners are registered for GST individually they can still argue that the property is not part of their individual enterprises. The problem arises when the owners are also in a partnership that is registered for GST, typical mum and dad situation where they also have a business. In this case they are reduced to trying to argue that they do not hold that property as part of the enterprise that is GST registered without much chance of success. You see once a business is registered for GST then any capital assets it sells are also subject to GST. This should form part of the decision making process when setting up a business or buying a property.

Do not be concerned if you have a GST registered business in a company or trust and own the property in individual names. The business is clearly a different entity to the owner of the property.

What If You Have Held The Property for Less than 4 Years?

As always the onus of proof on what your thoughts were, rests with you. The question throughout this is whether the property is part of your business turnover or a capital asset. A capital asset is something you acquired to hold and use to produce income. When you build a house to sell then it is part of your business turnover and counts in the $75,000 test.

If you are going to sell a property you built soon after it is constructed you have already given the ATO a good argument that you built it with the intention of selling and holding it as a rental was just a bonus, until you found a buyer. Do you have evidence to counter this? Do you have a change in circumstances that justify the quick turnaround of the property?

It is important to get this right otherwise the ATO could come along later and collect the GST after you have lost the opportunity to use the margin scheme or claim GST input credits. Further, the buyer’s solicitor may still want to withhold GST from the sale proceeds unless you have a ruling from the ATO which will take so long that the contract is likely to fall through in the meantime.

Our advice is that you apply to the ATO for a ruling explaining why you started out holding the property for rental but after a period of renting it out changed your mind and decided to sell. The key point is that you did not build it with the intention of selling. So, you are looking for a change of circumstances such as divorce, losing your job, interest rate increase making it unaffordable.

Conclusion

The bottom line is if the seller is in the business of renting residential property and the seller is not registered for GST, they do not have to pay GST on the sale. They are also not entitled to use the margin scheme because they are not registered, they don’t need to anyway. Any attempt to force the seller to register would have to be on the basis that they built the property with the primary intention of selling it for a profit, not the primary intention of an investment earning rental income. Mistake or not that very act of registering for GST will mean they then become liable to pay GST on the sale of a property they have built if they have not held it as a rental for a continuous period of 5 years. The 5 year test is really only relevant if they are already registered for GST. If they built the property to hold as a rental then they are not required to register for GST.

Convincing Your Conveyancer

The cornerstone is in Section 23-5 that states if the annual turnover of supplies you make in the normal course of your enterprise, exceed $75,000 you must register for GST. Section 185-25 excludes from the calculation of annual turnover the supply of a capital asset. So, building the property for rental then later selling, is the supply of a capital asset and not included in the annual turnover. Section 118-15 excludes from annual turnover input taxed supplies so any domestic rent received is not included in annual turnover.

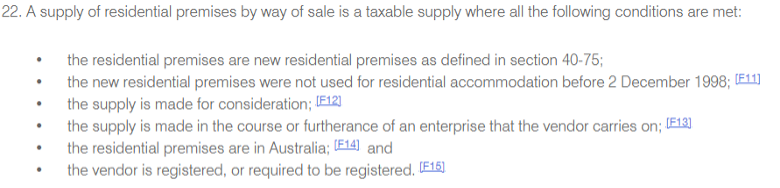

GSTR 2003/3 at paragraph 22, the last point shows that it is a question of whether you are required to be registered. The sections quoted above explain when you are required to be registered. https://www.ato.gov.au/law/view/document?locid=%27GST/GSTR20033/NAT/ATO%27&PiT=20090114000001

Julia's Blog

Julia's Blog