2024-2025 Federal Budget Summary

This is a very succinct summary of the budget, just the parts that we consider relevant to our clients’ financial decisions. There is plenty of detail available on web sites and in the newspapers, this blog is intended to help you just get the information you need in a way that relates to your situation.

Small Business Immediate Asset Write Off

Businesses you can now consider holding off spending money on new plant and equipment to utilise the immediate write off. The $20,000 cap announced in the 2023 budget was changed to $30,000 in the senate by the LNPs so still has not passed through parliament. The budget papers make it very clear the government is standing its ground on a $20,000 cap. The bill from the last budget still not having made its way through parliament has put businesses in a difficult position. Now at least businesses do not have to race for the 30th June 2024 deadline without even knowing what the cap will end up being and whether it will even be passed. Purchases can now be delayed, as long as they are installed ready for use by 30th June 2025. Though with tax brackets coming down in the 2024-2025 financial year a tax deduction now, before 30th June 2024 is worth more in tax savings. The $20,000 is net of GST if the business is registered for GST. Note the cost must actually be under $20,000 ie $19,999. The cap applies to each item so multiple items can be purchased. It would be unwise to rely on the $30,000 cap, proposed by the senate, making its way through Parliament.

Increase in Rent Assistance

Before landlords rub their hands together with rent assistance payments rising by 10%. The absolute maximum your social security recipient tenant will receive is less than $10 per week. How is that! Rents have doubled and the government is giving tenants an extra 10%. This comes into effect on 20th September 2024. Note last September, 2023 rent assistance went up 15%.

HECS and HELP Debts

As previously announced, the inflationary up lift to HECS debts that happens every 1st June will now be measured on the lower of CPI or Wages Growth. This will be back dated to 1st June 2023 so all those students who experienced an uplift of 7.1% last year will have it reduced to 3.2%.

Our experience is that if you have paid off your HECS debt and then through an adjustment become entitled to a refund it will just turn up in the bank account you list on your tax return with ATO in the description.

Apprentices

Over the next 4 years, starting 1st July 2024 the government will make a payment of $5,000 to apprentices in priority occupations and pay a $5,000 subsidy to employers of apprentices in priority occupations.

The priority occupations are listed here https://www.apprenticeships.gov.au/support-and-resources/financial-support-apprentices-priority-occupations with lots of useful information about each occupation, such as likely wage and future demand. There are also other incentives for apprentices on these sites https://www.apprenticeships.gov.au/support-and-resources/financial-support-employers and https://www.apprenticeships.gov.au/support-and-resources/incentives-explorer

ATO Recovering of Old Tax Debts

Legislation will be introduced to give the ATO discretion not to recover old debts from before 1st July, 2017. Some taxpayers have experienced the ATO withholding their current refund to cover an old debt on which recovery action had ceased years ago. Taxpayers were caught out with no records to challenge the claim. The ATO stated that they had no choice, that is what the law required them to do. Now the ATO can apply its discretion not to recover the debt and that is their current policy in relation to debts from back to before 1st July, 2017.

Paid Parental Leave

Superannuation will be paid on government parental leave starting 1st July 2025. So don’t get pregnant just yet. Another good reason to delay, is the number of weeks PPL you will be entitled to will increase to 24 weeks from 1st July 2025 and 26 weeks from 1st July 2026.

What you don’t need to worry about – just so you are sure

Foreigners CGT changes after 1-7-2025. This is all about the big end of town tax avoidance.

Likewise, the Future Made In Australia Incentives are directed at – industries involved in renewable hydrogen, green metals, low carbon liquid fuels, refining and processing of critical minerals and manufacturing of clean energy technologies including in solar and battery supply chains. Not much detail yet but benefits are unlikely to apply to small businesses. Hydrogen certainly seems to be in favour with the government.

Individuals receive $300 and businesses $325 off their electricity bills. This will all be taken care of through your electricity provider. Note it is not an instant windfall it will be credited in 4 quarterly instalments.

What to do now

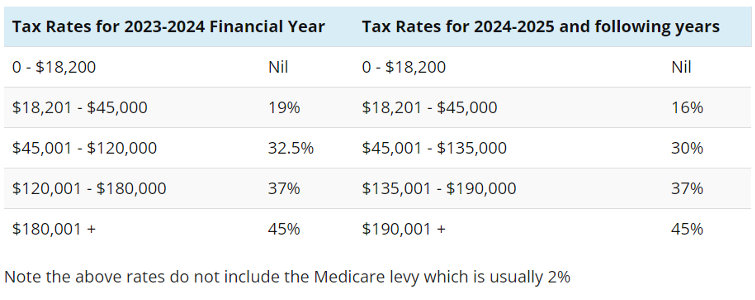

Next year most people will drop into a lower tax bracket.

That makes this year a very important year to maximise your tax deductions. For more details on the strategies you should consider go to https://www.bantacs.com.au/Jblog/2024-the-golden-year-of-tax-planning/#more-1633

Julia's Blog

Julia's Blog