Keeping the Nexus Between the Borrowing and the Expenditure

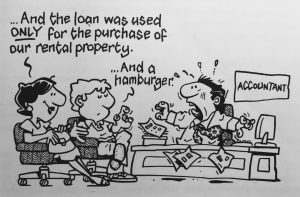

Keeping the Nexus Between the Borrowing and the Expenditure What the borrowed money is used to buy determines whether the interest on the loan is tax deductible. That is the basic rule. The link between the borrowing and the expenditure is called the nexus. This nexus needs to be very clear. You need to be …

PSI – Contractors Splitting Income

Allowances on PAYG Summaries

Help your employees give the ATO a raspberry to their new draconian bully tactics on reasonable allowances. This blog is both for employers and for employees who have read our article on travel allowances https://bantacs.com.au/Jblog/reasonable-allowance-concessions-effectively-abolished-by-the-ato/#more-159 If you are the latter make sure you give your employer a copy of this, so they can do …

Julia's Blog

Julia's Blog