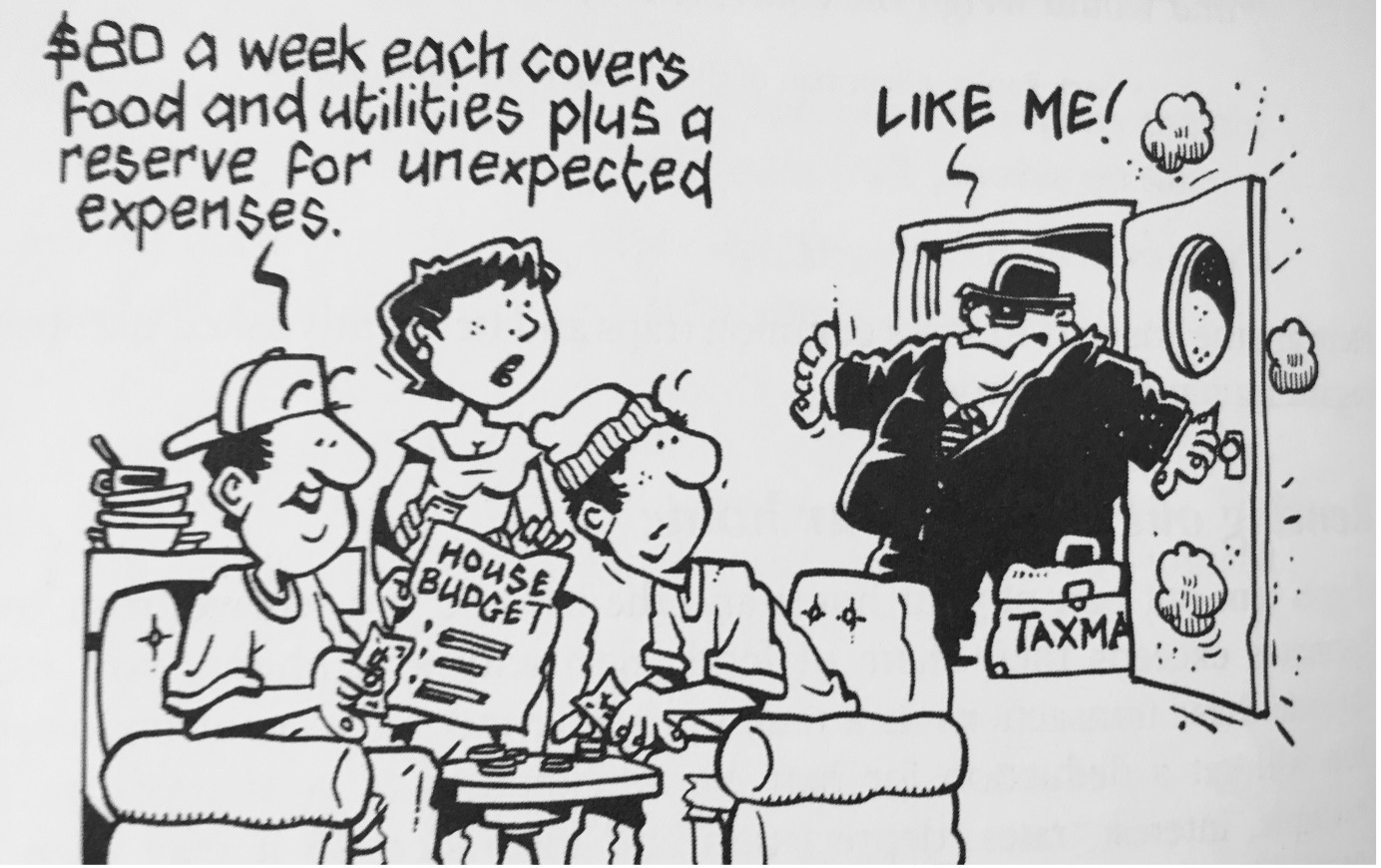

Reserve Bank Governor Phil Lowe has told struggling homeowners to rent out a room in their home so they can afford the increased interest rates. Nice to see someone with a take home pay of over $10,000 per week can empathise with the common people, but what about the tax consequences?

It is important to realise that the 6 year absent rule, that protects the politicians living in Canberra will not protect your main residence exemption in these circumstances because you are not absent from the house.

While it is an obvious solution to the housing shortage to fit twice the number of households into one home is it really going to benefit the householder in the end or just the taxman? Using your home to produce income for the first time will reset the first element of its cost base to its current market value. From that point forward, for the rest of your ownership period a portion of any capital growth (read tax on inflation) will be subject to capital gains tax (CGT). You will also need to keep records of all expenditure for the rest of your ownership period.

Let’s say for example when you first advertise your home for rent its market value is $600,000. You rent the room out for say $200 per week and calculate that a fair portion of the house used to produce rent would be 25%. This would be made up of say a per person share of the common living areas and the area of sole occupancy such as a bedroom. Now you might be entitled to a tax deduction for 25% of your interest, electricity, rates, insurance maybe even consider building depreciation. With the electricity bill likely to be the only expense that will actually increase. Note the depreciation claimable will decrease your cost base but I am trying to keep this simple. Hopefully, all of these deductions mean that you don’t actually end up paying tax on the $200 per week but make no mistake you need to declare the income and claim the expenses.

You may rent out this room for 5 years then be able to cope on your own. Not bad you probably collected $50,000 over that time. Maybe you keep the property for another 5 years after that but then sell to relocate for work etc. It is now 10 years since the cost base was reset to $600,000. It is reasonable to assume the property is now worth $1million just based on inflation. No real capital growth, it will cost you $1million to buy a similar house at the new location. But how much are you going to pay in tax because you rented out this room?

Warning strong numbers in this paragraph, sensitive readers might want to consider skipping to the conclusion. You are allowed to increase the cost base by costs of improving and holding the property, that have not otherwise been claimed as a tax deduction. This would include interest, rates, insurance, repairs and maintenance. Maintenance being key for record keeping nerds as it can even include cleaning materials, lawn mowing etc. This could be $30,000 to $40,000 a year very much determined by interest rates and the size of the mortgage. The mortgage balance will go down as insurance and rates go up over the years so let’s say an average of $35,000 a year, with very diligent record keeping. Now for the first 5 years 25% of these costs would have been claimed as a tax deduction against the rent you received for the room. Accordingly the cost base would be increased by $35,000 x 5 x 75% = $131,250 plus $35,000 x 5 = $175,000 a total of $306,250. Selling costs can also increase the cost base so maybe add another $30,000 for that, bringing the cost base up to $936,250. Leaving a capital gain of $63,750 reduced by the 50% CGT discount to $31,875. Now your main residence exemption will protect most of the house from CGT it is just 25% of half of the 10 years that is exposed. That is 12.5% of the gain is taxable, $3,984 of which you would only lose about a third in actual tax. CGT of $1,328 is certainly worth the extra $50,000 in income.

As long as you are prepared to commit to detailed record keeping for the rest of the time you own the property the CGT impact is minimal. Here is a tip. If you are still living in the property when you die then your heirs will inherit it with a CGT cost base of market value at the date of your death so all this CGT exposure is forgiven and forgotten. So, in this case it is death OR taxes. If you choose the taxes option then this spreadsheet will help you keep the records you need. https://www.bantacs.com.au/shop-2/protecting-your-home-from-cgt/

Julia's Blog

Julia's Blog