An overview from the budget papers for the issues that we think would most interest our clients.

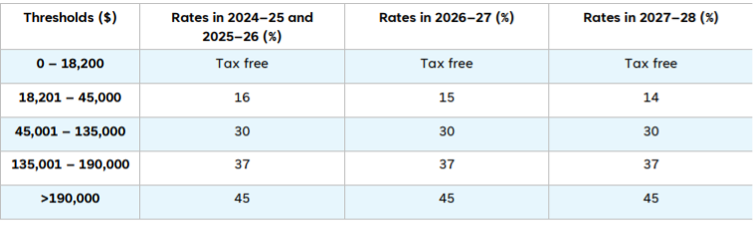

Income Tax Cuts – There will be a very modest adjustment to the lowest tax bracket currently 16%. This applies to income in the range of $18,200 to $45,000. From the first of July 2026 (more than a year away) the rate will drop from 16% to 15% then the following 1st July2027 another drop to 14%. Every taxpayer will see the benefit because it kicks in as soon as a taxpayer earns enough income to be required to pay tax ie over $18,200. From the 1st July 2026 taxpayers can expect to see another $5 per week in their pay packet increasing to $10 per week from 1st July 2027.

HECS Reduction – On 1st June 2025 all HECS debts will receive a 20% reduction so don’t go paying anything off your HECS debt before that date! The more you owe the bigger the reduction. When the HECS contribution is deducted from your wages it does not come directly off your debt. It is just treated like any other withholding tax instalment. It is not until you lodge your tax return that the repayment amount is calculated and actually reduces your debt. So don’t panic about what your employer takes out of your pay. From 1st July 2025 the income threshold at which students are required to start pay off their HECS debt will increase to $67,000 for the 2025-2026 financial year. Due to changes made in last year’s budget any inflationary adjustments to HECS debts will be the lower of, the consumer price index or the wages price index.

Housing – The thresholds for the Help to Buy Scheme have been increased but note the scheme is not yet operational. From 1st April 2025 there will be a 2 year temporary block on foreigners and temporary residents buying established homes.

Electricity Rebate – Every household and small business will receive at rebate of $150 on their electricity bill by 31st December, 2025. It will be paid at a rate of $75 per quarter.

Immediate Tax Deduction for Small Business Plant and Equipment – This is still set at $20,000 for the 2024 -2025 financial year but still not through parliament. As is the case every financial year, businesses cannot rely on this incentive because it does not become law until the dying days of the financial year it applies to.

The Forecast – The key indicators presented in the budget papers were:

| 2024-2025 | 2025-2026 | 2026-2027 | |

|---|---|---|---|

| Economic Growth | 2.25% | 2.5% | |

| Inflation | 2.5% | ||

| Wages | 3% | 3.25% |

Opposition’s Response – They would not proceed with the tax cuts but halve the fuel excise instead. This would be a reduction of 25 cents per litre but only for a year. They see the solution to rising energy costs is restricting the exporting of gas. Their housing policy involves reducing immigration by 25%, putting caps on foreign students and allowing first home buyers to use up to $50,000 of their superannuation to buy a home. The reply also included a two year restriction on foreigners buying Australian homes but this is already in place starting 1st April 2025.

Julia's Blog

Julia's Blog