Don’t forget to keep all the records you will need to be able to claim the associated costs as a tax deduction. None of the claims listed below will affect the CGT main residence exemption on your house. The CGT main residence exemption is more a factor of whether you see the public there or that it is advertised as a place of business.

Home Office on an Hourly Rate:

The easiest way to claim these expenses is simply use the ATO per hour rate, which was 52 cents for the 2018-2019 financial year. You will need to keep a diary record of the hours working from home, for at least one month to be able to justify your claim to the ATO. To help, or rather leave you with no excuses 😊, we have made our electronic diary available for download free of charge here https://www.bantacs.com.au/shop-2/diary-template/

In the 2019-2020 and the 2020-2021 financial years you will be required to keep two home office diaries if you want to claim for the period not covered by the COVID lockdown. You need to keep a diary for 1 month showing your home office hours for the non COVID period and one for the COVID period, in both financial years. PCG 2020/3 says that you can use timesheets and rosters to work out the number of hours you have worked at home.

ATO have just introduced an 80 cents per hour rate from 1st March to 30th June 2022, it is 52 cents an hour before that date. While this new rate is higher it is not necessarily a bargain. If you choose the 80 cents per hour rate you cannot claim separately for depreciation on your computer, use of internet, stationery or phone. They are all tied up in the 80 cents an hour unlike the 52 cent per hour rate. You still have the option of using the 52 cents rate to just cover furnishings and electricity and then claiming separately for your phone, electronic equipment, internet and stationery. This particularly important if you use your mobile phone for work as using the 80 cents an hour method will prevent you from being able to claim your mobile at all for that period. One mobile call an hour could exceed the 80 cents.

If you do choose the 80 cents per hour rate and have purchased items over $300 that you would normally depreciate, such as a laptop. Make sure you keep the receipt as in the following year you will be allowed to continue to depreciate it.

Home Internet:

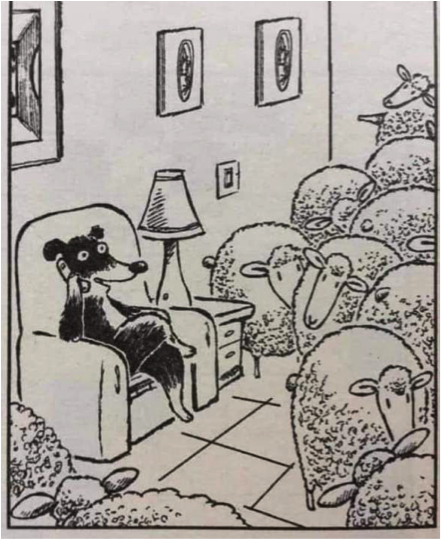

You can use the diary referred to above to work out the percentage of business to private use of the internet over a one month sample period. The catch is that you will have to record all the private use of all the members of the household. If you have children and Netflix, give up now!

Mobile Phone Use:

Again, you need a one month representative sample on which you can apportion the monthly plan fee. An easier alternative to the diary would be to go through your next phone statement and highlight the work-related calls. If your statement is not itemised then use the recent call log and print screen to create a list of the calls you have made over the last month.

Alternatively, you can claim up to $50 by estimating the number of your calls. Claiming 25 cents for a call from your land line, 75 cents for a call from your mobile and 10 cents for text messages.

Keeping Receipts for Stationery etc

Always remember to keep receipts. There will be some hidden costs you might not notice such as stationery, couriers, postage etc

Car:

If your home has now become your base of operations you may find you have to use your car more often. Make sure you don’t forget to record each trip in the diary as you should be able to claim 72 cents a kilometre, up to 5,000kms. Record the reason for the travel, the kilometers travelled and the destination. There is a vehicle diary in the second tab of the diary you can download.

Ways the ATO will attempt to deny your claim:

Work related claims are increasingly coming under attack from the ATO. Due to so many workers, they see even the smallest claim as a flood gate to a large loss of revenue. Further, as individual taxpayers cannot afford to fight the unlimited taxpayer funded and resourced ATO, setting the bar high appears to be the best strategy. By high I mean unachievable. Here is what you can expect:

- Requiring a letter from your employer stating that you needed to incur the expense. Even if you get one from your immediate supervisor they will ring head office, where no one really knows what is going on at your branch and claim that the letter was not verified.

- Any error in your diary or log book records no matter how human or irrelevant will be used to discredit the whole record to the extent of denying the full tax deduction.

- You will be required to apportion your phone bundle between internet and phone calls, which of course is not possible so your claim will be denied

- Require that the internet use be measured on a data basis rather than an hours used basis. Very difficult to achieve!

- With receipts they will require that you show bank statements to prove you have actually incurred the expense yourself. Enabling them to deny a claim for anything you have paid for in cash.

- If an expense is paid by your spouse or the receipt has your spouse’s name on it, the ATO will deny the deduction because you were not the one to incur the expense even though it is clear you have used the item to produce income.

Julia's Blog

Julia's Blog