At least the Reserve Bank has slowed down its rate of increase to only ¼%. Maybe that is a good sign the rate rises will stop soon.

These days I am regularly asked whether a client should fix their loan. This is all about which way rates will go over the fixing period. Now I don’t have a crystal ball or some special superior insight. In fact, probably the most reliable guess on the direction of interest rates would be the banks. Not your local bank manager but the banks themselves and that is reflected in what interest rates they are offering to give you a fixed loan. This is all about them betting they have a better idea then you which way interest rates will go. Also exploiting the fear factor to squeeze a bit more out of you.

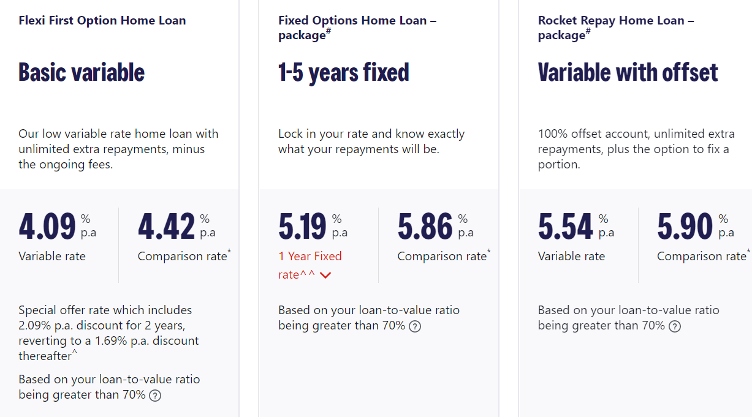

So what are the banks telling us? Well, here are Westpac’s current offerings though of course this doesn’t take into account any rate rises they may announce after the October increase by the RBA. I am using the comparison rate, as that takes into account fees etc.

| Basic Variable Home Loan | 4.42 |

| Variable Home Loan with Offset | 5.90 |

| 1 Year Fixed | 5.86 |

| 2 Year Fixed | 5.99 |

| 3 Year Fixed | 6.11 |

| 4 Year Fixed | 5.88 |

| 5 Year Fixed | 6.36 |

You would generally expect rates to increase over the fixed term as a premium for certainty, so the 4 year rate is very interesting. If you assume the banks are smart enough to win a bet with you about interest rates then they are really not expecting them to get much worse than 6%. Do the maths for the level of certainty you want. Here is an example for 1 year fixed verses variable. To keep it simple I have worked on interest only, the point is the same regardless.

If you had $100,000 loan fixed for one year you would pay $5,860 in interest according to the figures above. On the variable rate it will change each month. I think the worse case scenario would be an increase of ¼% each month for every month for the full year.

So the interest each month on $100,000 would be:

| January $100,000 x 4.42% / 12 | $368.33 |

| February $100,000 x 4.67% /12 | $389.17 |

| March $100,000 x 4.92% /12 | $410.00 |

| April $100,000 x 5.17% /12 | $430.83 |

| May $100,000 x 5.42% /12 | $451.67 |

| June $100,000 x 5.67% /12 | $472.50 |

| July $100,000 x 5.92% /12 | $493.33 |

| August $100,000 x 6.17% /12 | $514.17 |

| September $100,000 x 6.42% /12 | $535.00 |

| October $100,000 x 6.67% /12 | $555.83 |

| November $100,000 x 6.92% /12 | $576.67 |

| December $100,000 x 7.17% /12 | $597.50 |

| $5,795 |

Still less than the total interest paid over a year on a fixed loan at a higher starting rate and that is even allowing for interest rates to get to over 7% something the banks are betting won’t even happen 5 years from now.

The current 1 ½% extra interest rate for an offset account is also very telling. You would need to have nearly all the loan offset most of the time to win that bet.

I think the odds of you outsmarting the bank on interest rates are as good as a win on lotto or the pokies. My tip is stick with variable.

Julia's Blog

Julia's Blog