Victoria appears to be looking to solve its state debt with land tax. Last year saw the vacancy tax extended to most of the state, except for Alpine resorts https://www.bantacs.com.au/Jblog/victorias-latest-vacancy-tax/#more-1701

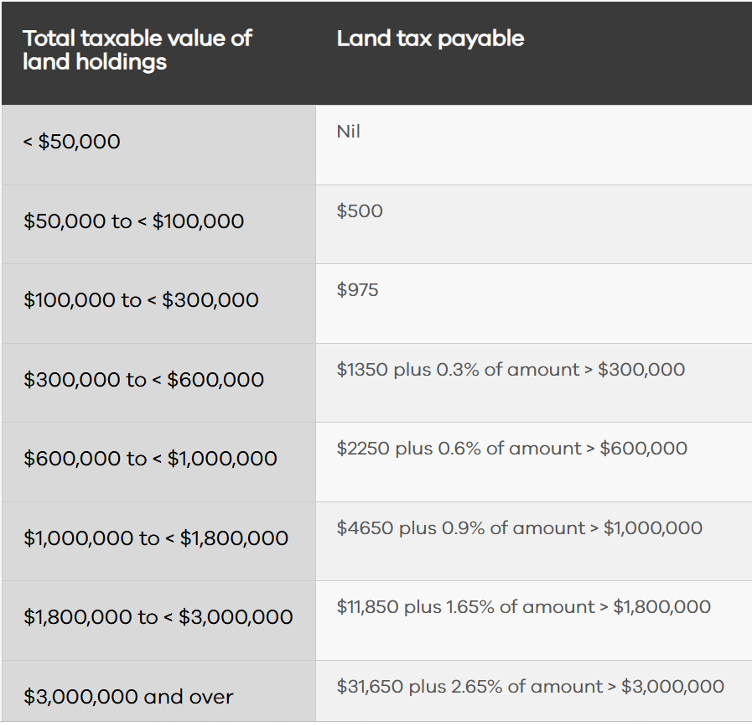

There was also the dropping of the land tax threshold from $300,000 for the 2023 year to $50,000 for 2024 and following years, collecting up most properties that are not fully covered by the principle place of residence exemption.

Even the most insignificant block of land is going to now attract land tax. This can also mean that a property covered by the principle place of residence exemption as well as being used in a business could be caught in the land tax net if the value of the area used in the business exceeds $50,000. The same applies if part of the property is being used as a separate residential rental, for example a granny flat. If the granny flat is earning income and occupies more than $50,000 worth of the land, based on the percentage of unimproved value, then land tax applies.

This trap for small business operators and people renting out part of their home, has been around for years but with a $300,000 unimproved value threshold not many people were caught unless they had other properties that already pushed them over the threshold. Now, use part of your home in a business and it is very likely you will hit the threshold. If the land value is $500,000 and you use more than 10% of the area as a rental or business activity you are caught.

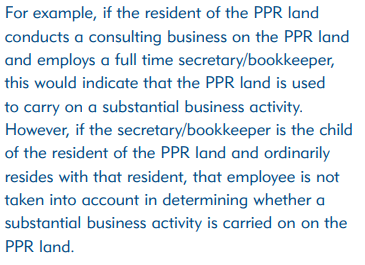

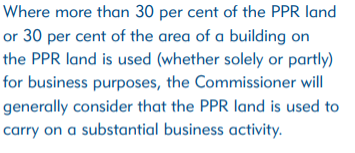

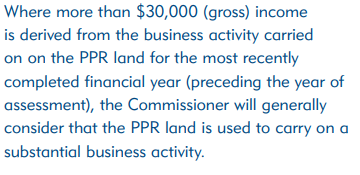

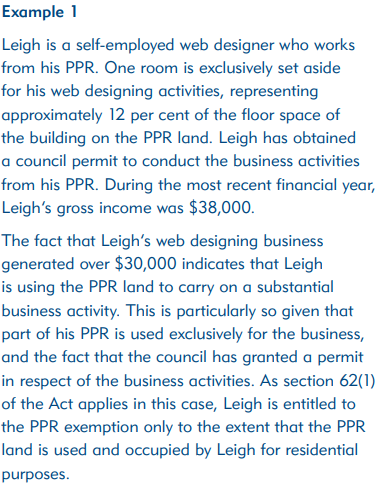

So what does used in a “substantial business activity” mean? It doesn’t take much. The following are some quotes from this ruling https://www.sro.vic.gov.au/sites/default/files/revenue-ruling-lta-001-v2.pdf

Land Tax Rates for 2024 and Following.

Julia's Blog

Julia's Blog