So When is the Best Time to Buy a New Vehicle? – Preferably Electric

Buying a new car has become more and more complicated over the years. I remember when it was just a matter of leafing through my father in law’s car review magazines going to the local dealer and picking out the colour. Now there is just so much more to consider and the wait times take a lot of shine off the process. Being in business or wanting to novate lease your new vehicle through your employer adds another level of complexity together with opportunity.

Another thing that has changed is clients craving that new car smell trying to get their Accountant to help them justify it from a tax perspective. Now the excuse is doing the right thing for the environment. A little known Labor Party platform may help you achieve both.

Little known, rarely spoken about and already past its proposed introduction date is the Labor party’s “Electric Car Discount Policy”

https://www.alp.org.au/policies/electric_car_discount/

It is enough to actually make you delay purchasing to wait and see if you might qualify. On the other end of that time line is the expiration of the immediate asset write off concessions on 30th June 2023. So, when should you buy, assuming you are going to buy before 30th June, 2023? It will take a crystal ball at the moment though I wouldn’t rush. It would be more sensible for the government to introduce the FBT concessions at the start of an FBT year, that makes 1st April 2023 my earliest pick. Giving you just 3 months to have the vehicle installed and ready for use before 30th June 2023 if you want to qualify for the immediate write off on the purchase price.

Now that you have the general gist of the issues here is the fine print as best is available at the moment.

The FBT Concession:

The government are talking about not charging Fringe Benefits Tax (FBT) on electric vehicles for at least 3 years. The policy, released before the election, included a reduction in tariffs and concluded these changes would apply from 1st July, 2022. There is nothing in parliament yet and I think the governments’ advisors are likely to say, set the start date for a fresh FBT year namely 1st April 2023. If the eventual legislation applies only to vehicles purchased after that date then it is worth the wait. Though it may just end up applying to all electric vehicles provided as a benefit in that FBT year regardless of when purchased. I think applying the concession to cars already purchased is unlikely because the intent of the governments’ policy is to encourage more businesses to buy electric cars. I think it most likely the FBT concession will only apply to cars purchased after the date the concession is introduced.

As a general rule of thumb the FBT on a car is normally round 20% of the purchase price of the vehicle, payable each year until the vehicle has been held for at least 4 full FBT years when it reduces to 2/3rds of 20%. That is a lot of tax even just over the 3 year minimum, it is effectively 60% of your purchase price. Note, for full disclosure, the tax can be reduced a little, by making an employee contribution, if you are not in the maximum tax bracket.

Nevertheless, this is a huge saving to your salary package or your business. It means not only does your employer get all the GST back on the purchase price and ongoing expenses but even though there is private use of the vehicle the expenses are effectively paid out of before tax dollars.

Below is an extract from Labor’s Electric Car discount announcement https://www.alp.org.au/policies/electric_car_discount/

“As part of the Discount, Labor will exempt many electric cars from:

Import tariffs – a 5 per cent tax on some imported electric cars; and

Fringe benefits tax – a 47 per cent tax on electric cars that are provided through work for private use.

These exemptions will be available to all electric cars below the luxury car tax threshold for fuel efficient vehicles”

The Immediate Write off:

If you are a small business, you can claim a full tax deduction for any plant and equipment you buy for your business, as long as it is installed ready for use by 30th June, 2023. Having said that, when it comes to cars there is a cap which is discussed below under the heading of Luxury Car Limit.

The immediate write off concessions will not work for a novated lease arrangement or for any lease arrangement for that matter because the vehicle is simply rented, not purchased. This causes a problem when the employee wants to effectively own the car but have their employer make the lease payments in order to get the GST back and some of the motor vehicle expenses effectively paid out of before tax dollars.

The immediate write off provides quite an incentive for the employer to own the vehicle, that is assuming the employer has a tax problem. It also provides an incentive to purchase your car and have it installed ready for use before 30th June 2023.

The Luxury Car Limit:

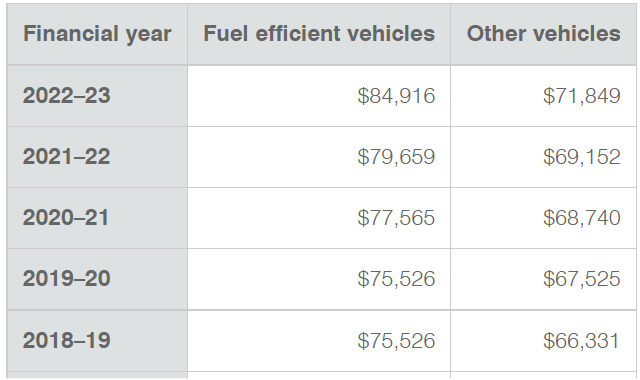

The statement from the ALP page limits the concession to only electric cars that are under the luxury car limit which is:

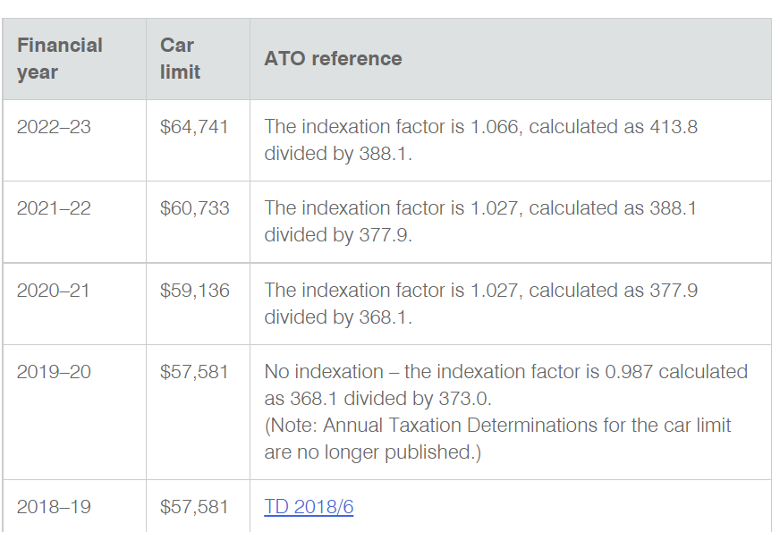

It is important to note there is a difference between the luxury car tax threshold in the table above and car limit for depreciation purposes in the table below. You will qualify for the FBT concession if your car is under the luxury car tax threshold but you will not be able to depreciate all of its value unless it is also under the car limit for depreciation. Anything above the car limit amount below is excluded from the depreciation calculation including immediate write off.

So here is another date sensitive issue, if you wait until after the 30th June, 2023 you have a better chance of the price coming under these limits but you will miss out on the immediate write off. Note the immediate write off is not always a sensible move, the depreciation deduction maybe more valuable to you in future years, claimed as a lump sum it may reduce you down to only the 19% tax rate, wasting future tax deductions. On the other hand prices of electric cars may go up just as much as the thresholds do anyway.

Note the thresholds above apply to cars, so if the vehicle you are buying is a non car for example a vehicle designed to carry more than 1 tonne then there is no limit. An interesting tip in this regard is the threshold is measured against only the purchase price, only the first element. Once you have the vehicle in use you can further modify it and even though that extra cost may take it over the threshold, it does not matter, as long as the original purchase price is under the limit.

The flip side of this is, once a car always a car. So if you buy a car and modify it to the extent that it is a non car it won’t change it from being treated as a car for the depreciation limit. Though if the modifications are done after it is installed ready for use then they are depreciated or written off separately so not capped.

Careful if the vehicle you are purchasing starts life as a non car then it might not even qualify for the FBT concession, we won’t know until the legislation is presented.

In summing up or answering the question I started with. If you are considering buying an electric vehicle that will cost less than $84,916 then it is worth waiting a while to see if something gets up before parliament regarding the FBT concessions. Be careful if immediate write off is important to you, you may be struggling to have it installed ready for us by 30th June 2023.

Newsflash – The Bill is Now Before Parliament

Here are some of the specifics, though remember this can change:

| Low and zero emission cars | • Battery electric vehicles; • Hydrogen fuel cell electric vehicles; and • Plug-in hybrid electric vehicles. Be careful here because this doesn’t include all hybrid vehicles. To qualify the car needs to be ‘plug-in’. A car that has an internal combustion engine will not meet requirements unless it is able to be fuelled by a battery that can be recharged by an off-vehicle power source. |

| The car was first held and used on or after 1 July 2022 | Where the car is first held and used on or after 1 July 2022. Provided the conditions of the exemption are met, an electric car that was ordered prior to 1 July 2022, but was not delivered until after 1 July 2022 would be eligible for the exemption (even if an employer acquired legal title to the car before 1 July 2022). However, a car delivered to you prior to 1 July 2022 would not qualify. A second-hand electric car may qualify for the exemption, provided that the car was first purchased new on or after 1 July 2022. |

| Value below luxury car tax threshold for fuel efficient vehicles | The value of the car at the first retail sale must be below the luxury car tax threshold ($84,916 in 2022-23) for fuel efficient vehicles. The luxury car tax threshold generally includes GST and customs duty but excludes other items such as service plans, extended warranties, stamp duty and registration. |

EV State and Territory tax concessions

ACT

The ACT Government offers a stamp duty exemption on new zero emission vehicles, and up to two years free registration for new or second hand zero emission vehicles (registered between 24 May 2021 and before 30 June 2024).

New South Wales

Reimbursement of stamp duty paid on purchases of new or used full battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs), with a dutiable value up to and including $78,000.

Northern Territory

For plug-in electric vehicles (battery and hybrid plug-in), from 1 July 2022 until 30 June 2027, access free registration for new and existing vehicles and a stamp duty concession of up to $1,500 on the first $50,000 of the car’s market/sale value – 3% thereafter.

Queensland

Discounted registration duty for hybrid and electric vehicles. And, a limited $3,000 rebate for new eligible zero emission vehicles with a purchase price (dutiable value) of up to $58,000 (including GST) on or after 16 March 2022.

South Australia

A limited $3,000 subsidy and a 3-year registration exemption on eligible new battery electric and hydrogen fuel cell vehicles first registered from 28 October 2021.

Tasmania

From 1 July 2022 until 30 June 2022, no stamp duty applies to light electric or hydrogen fuel-cell motor vehicle (including motorcycles). Vehicles with an internal combustion engine do not qualify.

Victoria

A limited $3,000 subsidy is available for new eligible zero emission vehicles purchased on or after 2 May 2021. More than 20,000 subsidies are available under the program. Plus, stamp duty for ‘green passenger cars’ is set at the one rate regardless of value ($8.40 per $200 or part thereof). Zero emission vehicles receive a $100 annual registration concession but are also subject to a per kilometre road user charge.

Western Australia

A $3,500 rebate on the purchase of a new zero emission, hydrogen fuel cell or battery light vehicle with a value of up to $70,000 purchased on or after 10 May 2022.

Julia's Blog

Julia's Blog