General Deductions:

You can only pay a maximum of 12 months in advance. In the case of interest payments check if the bank will let you do this and that they do treat it as an interest payment not just let it reduce the loan balance.

If you pay rates, insurance or body corporate fees in advance think carefully about the no more than 12 months in advance rule. If your body corporate fees are already paid up to 31st December 2022 you can’t pay another 12 months’ worth, you need to just pay 6 months extra.

Land tax is treated differently. When you receive land tax assessments in arrears, the amount of land tax is not deductible in the income year in which you pay the arrears. The land tax amounts are deductible in the respective income years to which the liability for the land tax relates.

Be careful, some commercial tenants, for their own tax planning strategy, may want to pay rent in advance. This may suit the tenant but may not suit you the landlord. Unless you can apply the Arthur Murray principle, ie claim that there is a risk that you may have to refund that income. Otherwise, you are stuck with declaring it as income in the year received.

Repair, Improvement or Replacement in its Entirety?

This is a fundamental question all property investors need to understand as the tax treatment varies considerably.

With repairs and maintenance, you have to at least incur the expense before the end of this financial year. This means organising for the work to be done even if you have not paid for it yet. This is particularly important if your tenants have moved out and you do not intend re letting the property. If you don’t incur the repairs now you will not be entitled to a tax deduction next year because the property has not earned any rental income in that year. Reference IT 180.

So just what is classed as a repair? Initial repairs are not deductible. If the house needed painting when you bought it then painting it would be an improvement so only depreciated at 2.5%pa. You do not need a quantity surveyors depreciation report to claim the depreciation, you simply need the receipts for the expenses you have incurred.

A repair is not deductible if it is an improvement. An improvement is restoring the property to a condition that is better than the state it was in when you bought it. A repair can become an improvement, if the repair goes beyond just restoring things to their original state, for example replacing a metal roof with tiles is not a repair. But a change is not always an improvement. The ATO says the cost of removing carpets and polishing the existing floorboards is a deductible repair, yet underpinning due to subsidence is considered to be an improvement. Pulling up old floor tiles and replacing them with similar tiles would be a repair as long as the tiles were not in disrepair when you purchased the property.

Take care to perform repairs only when the premises are tenanted or in a period where the property will be tenanted before and after with no private use in the middle. If a property is used only as a rental property during the whole year, then a repair would be fully deductible even though some of the damage may have been done in previous years when the property was used for private purposes.

Don’t replace something in its entirety. For example, replace a worn fence a bit at a time over a few years rather than all at once. Replacing all of the cupboards in a kitchen so they match rather than just the damaged one will mean that none of the expenditure is deductible. Consider just replacing the doors so it is not a replacement in its entirety. On the other hand, replacing a vanity can be deductible as a repair if the pipes from the old vanity are used.

Tree removal is claimable if the trees have become diseased or infested during the time of ownership. Removal is also claimable if the tree is causing damage such as roots interfering with pipes, but not if the damage was present when you purchased the property. If a tree is removed because it may cause damage in the future or you are fed up with the leaf litter that has always happened since you bought the property, then you are making an improvement which is not tax deductible, it will only be useful in your CGT calculation.

As plant and equipment are usually depreciated over many years buying them towards the end of the financial year could mean you only qualify for one month’s depreciation which would be a very small fraction of what you have spent. Don’t forget, unless it is brand new to you, there is no tax deduction. The immediate write off concessions do not apply to items used to produce a passive income.

Plant and Equipment costing $300 or less, per owner, can be written off immediately. A rangehood costing $500 can be written off immediately if the property is owned as joint tenants. Like items must be added together when applying the $300 test so it may be better to buy one set of curtains this year and wait until July before you buy the next set. Items costing under $1,000 per owner, will qualify for depreciation of 18.75% in the first year, regardless of when you purchase them, then 37.5% in following years. A $1,900 hot water system for a property owned by 2 people would qualify as under $1,000.

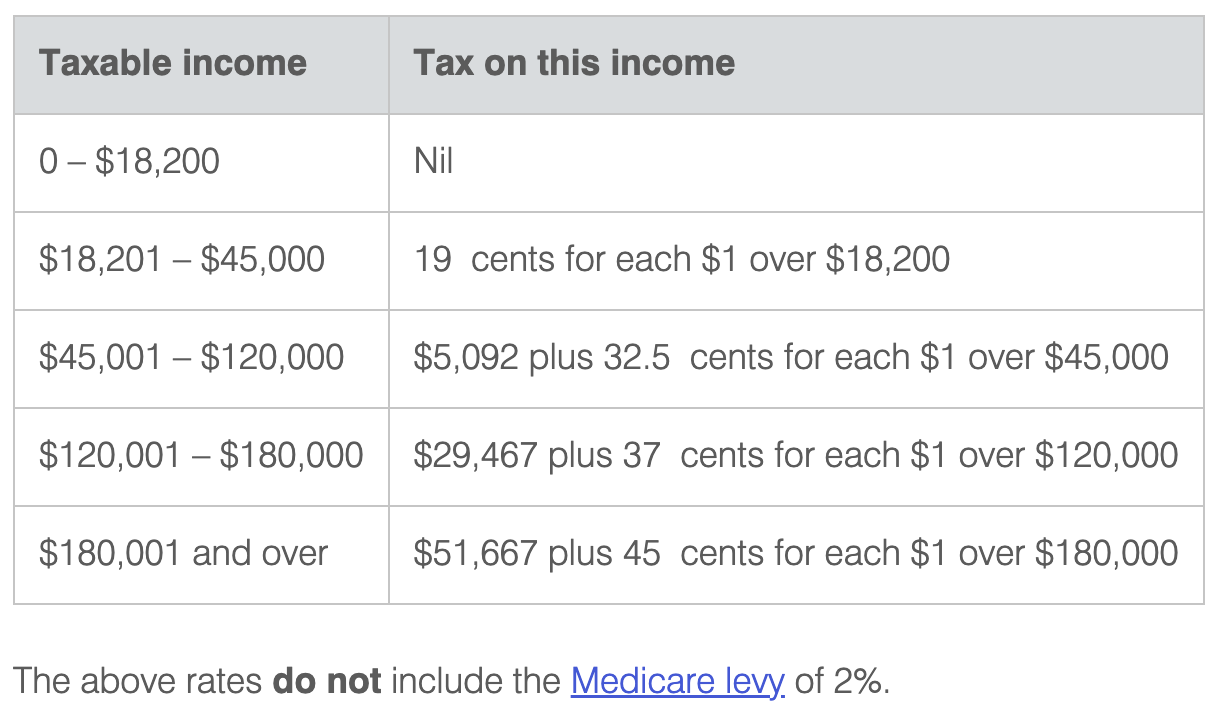

Another thing to consider is whether you would be better saving the tax deduction for the following year if you are likely to be in a higher tax bracket.

In the 2022-2023 and future years there will be no Low to Middle Income Tax Offset so many taxpayers are in for a shock when they lodge there tax return. There refund could be reduced by as much as $1,500

From 1st July 2024 taxpayers earning over $45,000 but under $200,000 will pay a maximum tax rate of 30% plus Medicare.

Julia's Blog

Julia's Blog