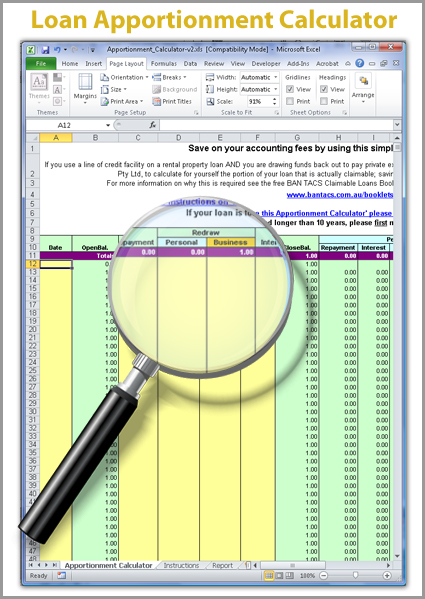

If you use a line of credit facility on a rental property loan AND you are drawing funds back out to pay private expenses, use this simple Apportionment Calculator to calculate, for yourself, the portion of your loan that is actually claimable; saving you the expense of having your accountant do it for you.

Line of credit facilities dangerous

It is dangerous to use a line of credit facility on a rental property loan when you will be drawing funds back out to pay private expenses. Based on the principle that the interest on a loan is tax deductible if the money was borrowed for income producing purposes, the interest on a line of credit could easily become non-deductible within 5 years. For example: A $100,000 loan used solely to purchase a rental property is financed as a line of credit. To pay the loan off sooner the borrower deposits his or her monthly pay of $2,000 into the loan account and lives off his or her credit card which has up to 55 days interest-free on purchases. The Commissioner now considers there to be $98,000 owing on the rental property. In say 45 days when the borrower withdraws $1,000 to pay off his or her credit card the loan will be for $99,000. However, as the extra $1,000 was borrowed to pay a private expense, viz the credit card, now 1/99 or 1% of the interest is not tax deductible.

Accounting fees for calculating the percentage deductible could be high

The next time the borrower puts his or her 2,000 pay packet into the account the Commissioner deems it to be paying only 1/99 off the non-deductible portion i.e. at this point there is $96,020 owing on the house and $980 owing for non-deductible purposes. When, 45 days later, the borrower takes another $1,000 out to pay the credit card, there will $96,000 owing on the house and $1,980 owing for non-deductible purposes so now only 98% of the loan is deductible, etc, etc. In addition to the loss of deductibility, the accounting fees for calculating the percentage deductible could be high if there are frequent transaction to the account. The ATO has released TR2000/2 which confirms this and, as it is just a confirmation of the law, it is retrospective.

To ensure deductibility

To ensure deductibility and maximise the benefits provided by a line credit you will need an offset account that provides you with $ for $ credit. These are two separate accounts – one a loan and the other a cheque or savings account. Whenever the bank charges you interest on the amount outstanding on your loan they look at the whole amount you owe the bank i.e. your loan less any funds in the savings or cheque account.

For more information on why this is required see the free BAN TACS Claimable Loans Booklet available in the Booklets Section of this website.

Note: This is an MS Excel file; for help using BAN TACS Accountants Excel Calculators and Spreadsheets go to our BAN TACS Excel Help page.