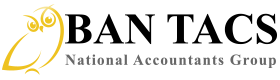

There is so much more to calculating CGT than just deducting the price you paid from the selling price. We have covered common scenarios here and tried not to bog it down with the more complex CGT issues. Accordingly, this spreadsheet should only be used as a guide. When it comes to calculating the CGT to include in your income tax return, please consult a tax qualified accountant.

Easy to use

The spreadsheet comes with a worked example, notes and pop up boxes to help you along the way. Once again it is guaranteed not to have fancy bells and whistles or detailed, complex instructions. Everything is clearly displayed in front of you.

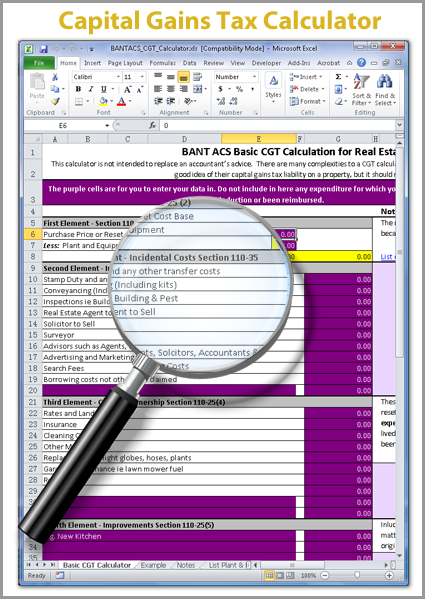

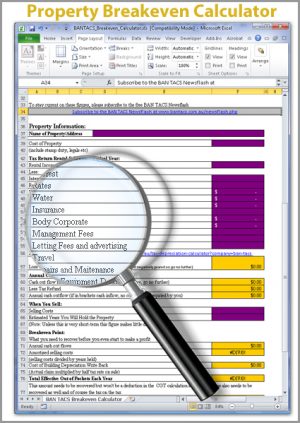

An excellent tool to possibly help you realise that it is better to borrow against the property for your next investment then be left with the after tax amount. Or if you have already sold the property, it will give you an idea of what to put aside, out of the proceeds, to pay your tax. It may even show you that you cannot afford to sell the property!

This calculator is only for real estate assets. It does not consider indexing as it would be extremely unusual for indexing to give you a better outcome because you would not be entitled to the 50% CGT discount.

Note this spreadsheet is only to work out the CGT on your property, not a record keeping tool. If you are looking for our CGT record keeping spreadsheets go to these links:

The full suite http://www.bantacs.com.au/shop-2/getting-your-affairs-in-order-made-simple/

Just for properties on more than 2 hectares http://www.bantacs.com.au/shop-2/cgt-record-keeping-and-tricks-for-homes-on-more-than-2-hectares/

Note: This is an MS Excel file; for help using BAN TACS Accountants Excel Calculators and Spreadsheets go to our BAN TACS Excel Help page.