The first step is to read the instructions to find out how all the CGT concessions could apply to your property. Make a plan and divide your property into the various strategic areas. There is a different spreadsheet for each area:

Main Residence – Up to 2 hectares that is used in the same way as the house

Cabins and Agistment – Areas used to produce income but too passively to qualify for the small business concessions.

Used in a Business – Possibly some sort of primary production. If used this way for half the time it is owned or 7 ½ years whichever is the shortest period the small business concessions could mean no CGT at all payable on this area.

Never Income Producing – May end up combing with the main residence to be exempt but if more than 2 hectares look for reason that the capital gain on this area is less than the average for the property. For example it may be flood prone and as worthless when you sell as it was when you bought so no capital gain. Alternatively, this area may have incurred exceptional capital expenditure that is not reflected in its resale value. For example stables that have now fallen into disrepair.

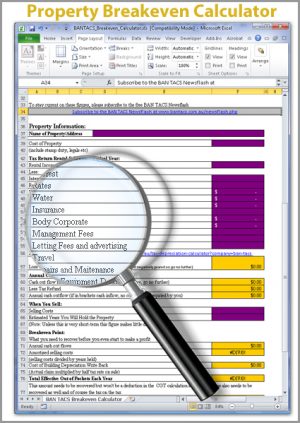

There are also huge tax savings in the record keeping. Did you know that section 110-25 (4) ITAA 1997 allows you to increase the cost base (reduce the CGT) by holding costs such as interest, rates, insurance, repairs and maintenance that have not otherwise been claimed as a tax deduction. So keeping track of slashing costs, fencing, irrigation, plants etc will add up to reduce your capital gains tax.

As you can see careful planning and good record keeping will reduce your tax liability considerably. A little effort here understanding the strategies and keeping the right records will probably give you the best hourly rate return of your life.

More information about the strategies is available in our blog https://bantacs.com.au/Jblog/cgt-when-your-home-is-on-acreage/#more-21