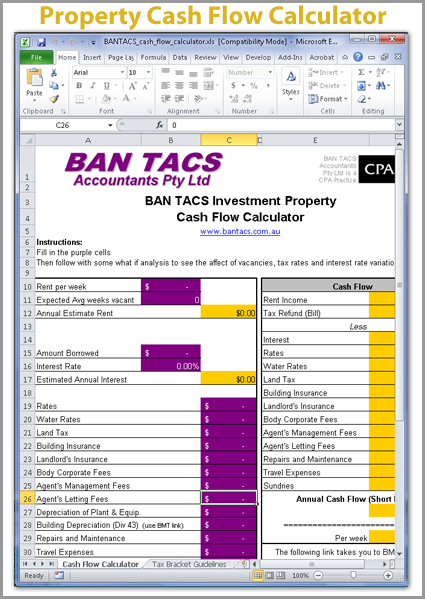

Are you betting on the capital growth

When you buy a negatively geared property you are betting on the capital growth exceeding the losses you incur. This calculator will help you work out whether you can afford to hold onto the property. It shows you what items affect your tax return and what affect you cash flow including your tax refund cheque. Again there is nothing flash about this calculator everything appears on the screen in front of you in an excel spreadsheet. Keeping it clear and simple. The idea is to change the data to do some what if analysis. For example see if you can afford to hold onto the property if interest rates go to 9% or if your tax bracket drops reducing the cash flow from your tax refund. The more you play around with all the possible outcomes the more confident you will be of your purchase even when times get tough. Tip – interest rates generally rise because of inflation so if interest rates get to 9% you will probably have more equity in the property to borrow against to get you through a rough patch and you wouldn’t expect interest rates to stay that high for years on end.

Taxable loss on a property and the cash flow

There are two differences between the taxable loss on a property and the cash flow. The first is your refund cheque created by the loss generated by the property and the second is depreciation. Depreciation is tax deductible but as it is a claim for the wear and tear on the original purchase it does not cost you any cash flow each year. This is not quite true with depreciation on plant and equipment because these items will eventually have to be replaced so the refund it generates it is only a temporary cash inflow. Generally the refund on building depreciation can be considered a permanent cash inflow but of course it will reduce your cost base when you sell.

The depreciation rate of 2.5% takes 40 years

If the property was build after 17th July, 1985 or there have been improvements since that date the amount you can claim for building depreciation will have a significant effect on your bottom line. The catch is this calculation should be undertaken before you purchase the property but, unless the seller has a depreciation schedule you can use, you are going to have to use an estimate because it is probably not worth the cost of paying for a professional one until you are sure you are going to buy. Fortunately, BMT have an estimator on their web site: BMT Estimator. You will need to know the year the property was built and the square metre area. Take the estimate building costs from the BMT site and multiply them by 2.5% to calculate the annual amount that can be deducted. Note if the property was built or the improvements undertaken between 17th July, 1985 and 16th September 1987 then the rate is 4% which means there will be no depreciation left to claim in a couple of years. At a depreciation rate of 4% the building will be fully written off by the time it is 25 years old whereas the 2.5% rate takes 40 years, from the date of construction, to be fully expended.

Depreciation on plant & equipment

For depreciation on the plant and equipment you can use an estimate of the secondhand values amortised over their effective lives. If you choose the diminishing value rate, each year you can only apply your depreciation rate to the original value less depreciation claimed so far but the diminishing rate is twice the flat rate over the effective life. So for example say a dishwasher with an effective life of 10 years that has a second hand value, at the time you purchased the property, of $1,000. Under the diminishing value method the claim in the first year would be 20% of $1,000 which is $200 but the following year it would be 20% of $800 ($1,000-$200). Under the flat rate or prime cost method the claim would simply be $100 per year ($1,000 x 10%). For the purposes of this calculator use the prime cost method.

The following are the effective lives of some common items of plant and equipment.

| Ceiling Fans | 5 years | Floor coverings | 10 years | Blinds | 10 years |

| Curtains | 6 years | Dishwashers | 10 years | Stoves | 12 years |

| Hot water systems 15 years for solar 12 years for Gas and Electric | |||||

Take your analysis further with Breakeven Calculations

If you would like to take your analysis further you should calculate the capital growth, after tax, required to at least breakeven after absorbing all those losses during the period of ownership. This can be done through our Breakeven Point Calculator, also available on BAN TACS Calculators shopping page. It is an excellent tool for bringing two very different properties down to a common denominator taking all factors into account. The common denominator being the percentage of capital growth required.

Note: This is an MS Excel file; for help using BAN TACS Accountants Excel Calculators and Spreadsheets go to our BAN TACS Excel Help page.

Reviews

There are no reviews yet.